- Real World

- Posts

- Halfway to the Future: Can PayPal’s PYUSD Grow Into a True Payments Powerhouse?

Halfway to the Future: Can PayPal’s PYUSD Grow Into a True Payments Powerhouse?

Plus Fiserv is launching a bank-friendly USD stablecoin by year-end

Hello Real World!

I’m Chris (@storaker), and this is Real World—The Defiant’s weekly update on what matters in stablecoins, tokenization, and RWAs. If trillions of dollars are marching on-chain, this newsletter is your front-row seat.

In this issue we zero in on PayPal’s digital dollar: on Thursday CEO Alex Chriss conceded consumer adoption of stablecoins will take a long time. Rewards, and fresh partnerships have been announced. Whether that’s enough to turn PYUSD into a mainstream payments rail, or just PR pyrotechnics, is what we’ll look into.

Let’s get real,

Chris

Top Moves This Week

PayPal CEO: Stablecoins lacks a killer perk — Alex Chriss told Bloomberg TV “there isn’t a real incentive” for US users to adopt stablecoins.

Fiserv readies “FIUSD” on Solana — The $3T TPV payments giant is set to ship a bank-friendly USD stablecoin by year-end, wired into its core systems that touch 10k banks and 6M merchants. Paxos & Circle will handle the infrastructure; deposit-token options are on the roadmap.

Halfway to the Future: Can PayPal’s PYUSD Grow Into a True Payments Powerhouse?

Alex Chriss didn’t sugar-coat things this week. “From a consumer standpoint, there isn’t a real incentive to drive adoption, which is why we’re starting to create things like rewards”, the PayPal CEO admitted when asked why PYUSD, the fintech’s stablecoin, hasn’t gone mainstream yet.

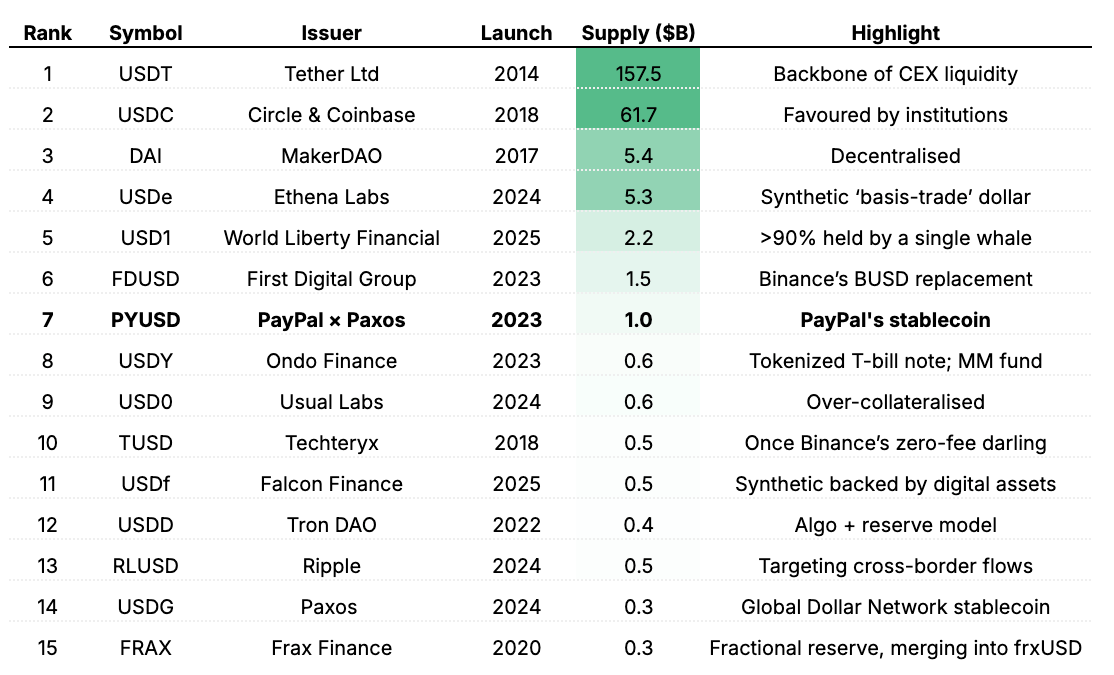

The Largest Enterprise Stablecoin

PYUSD is the 7th-largest stablecoin, with approximately $1B in circulating supply. That is a rounding error next to USDT and USDC, with $150B and $62B, respectively.

However, PYUSD still ranks in the top-3 of the “new-wave” stablecoins (no, USD1 doesn’t count), is the largest issued by a fintech, and is among the few seeing use outside of crypto.

To Rise and Fall, and Rise Again

After launch in August 2023, PYUSD’s supply ambled along at roughly $300M through early-2024, then rocketed once the token bridged to Solana in May 2024 and PayPal began pumping incentives on Kamino vaults, MarginFi lending, and Drift perps pools. After spending in the order of $25M, the float peaked at around $1B in August — 3x in three months.

When those subsidies tapered off in Q4, the “mercenary” capital retreated and supply slipped to a mid-$500M floor; yet it never fell back to pre-Solana levels.

Since then, we’ve seen PYUSD’s supply claw its way back to $1B, but no fresh DeFi ‘bribes’. In its place, we’ve had a flurry of product /PR announcements and high-sounding partnerships. So, is this the real thing?

What it Can Be Used For

In your wallet, so you can do whatever you like

Unlike its walled-garden enterprise cousins, PYUSD is a proper, real stablecoin that you can hold in your own self-custody wallet today. Minted natively on Ethereum and Solana and soon on Stellar, you can transfer it and plug it into smart-contracts, dApps, etc.

Not so much in PayPal’s own ecosystem

PYUSD currently permeates the consumer wallet layer and one flagship money-movement rail (Xoom). Integration into PayPal’s merchant stack and third-party processing units (Braintree, Zettle, Hyperwallet at scale) remains largely aspirational

Consumer apps

🟢 Wallet and P2P. 50M US PayPal and 64M Venmo users can buy, sell, hold and P2P-send PYUSD on both Ethereum and Solana.

🟢 Yield /rewards. Starting this summer, all US balances will earn 3.7 % APY in PYUSD, a direct nudge to keep dollars on-chain.

🟢 Remittances. US sender funds with PYUSD on Xoom with $0 transfer fee; PYUSD settles to partners (e.g., Yellow Card, Cebuana) in seconds.

🟡 Checkout. Online checkout with Crypto technically supports PYUSD, but PayPal still auto-converts the token to fiat at the last mile so 36M merchants never see it. Stablecoin settlement is planned for later in 2025.

🔴 Cards & VAS. The PayPal /Venmo debit card pulls from the fiat balance; there is no direct spending from the PYSUD balance, and there is no integration to BNPL or other VAS.

Business and enterprise solutions

🟡 Vendor bill-pay. PYUSD bill-pay will let 20M merchants invite vendors and pay them in stablecoin. In pilot, planned for later in 2025.

🟡 Mass-payouts. Contractors, freelancers-opt to receive PYUSD from Hyperwallet disbursements. Limited support.

🔴 Acquiring gateway /PSP. Enterprise Payment Solution (Braintree) which handles a third of PayPal’s $1.68T TPV, nor Zettle POSs support PYUSD payments.

🔴 Enterprise B2B. No support for PYUSD. Some pilots (e.g. SAP × EY PoC)

A growing partner network makes good headlines

Exchanges. PYUSD is listed on several major centralized exchanges, including its zero-fee, instant USD-redemption, strategic alliance with Coinbase.

Card & processor rails. Mastercard just added PYUSD to its “Move” and Multi-Token Network stack, promising global routing alongside USDC, FIUSD and Paxos’ new USDG.

Core processors. Fiserv’s freshly announced FIUSD will be interoperable one-for-one with PYUSD for cross-border payouts and merchant settlement, opening the door to 10k banks and 6M Clover merchants.

Banks. FV Bank (Puerto Rico OCC-regulated) integrated PYUSD (and USDC, USDT) directly into USD accounts—enables seamless on/off-ramps for stablecoins.

Does anyone care?

“We track velocity, active wallets and number of transactions—not market-cap rankings.”

It’s hard to tell. This is what we can see on-chain:

Monthly active wallets soared from 30k to about 50k (+70% increase), according to Visa’s Onchain Analytics Dashboard, more than any of its peers, but still dwarfed by USDC’s 10M.

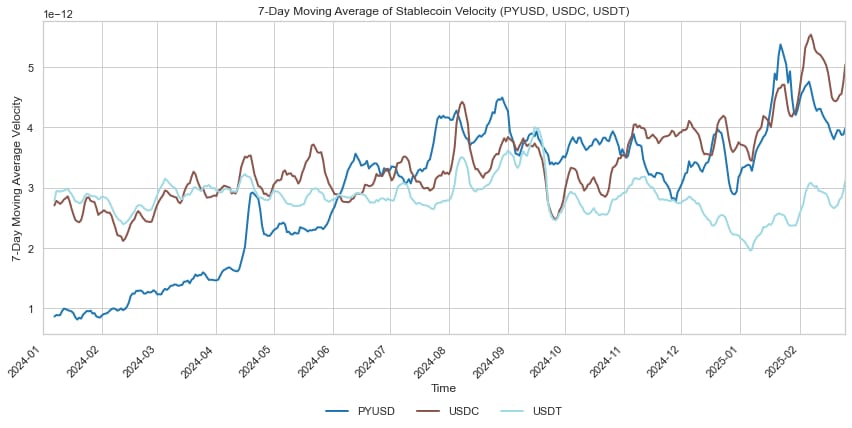

At the same time, velocity — PayPal’s stated north-start metric — (measured as transaction volume over supply) has held and even increased since the DeFi-infused frenzy last year, and hovers on par with the much more established USDT and USDC.

PYUSD’s velocity on par with more stablished stablecoins. Source: Amberdata

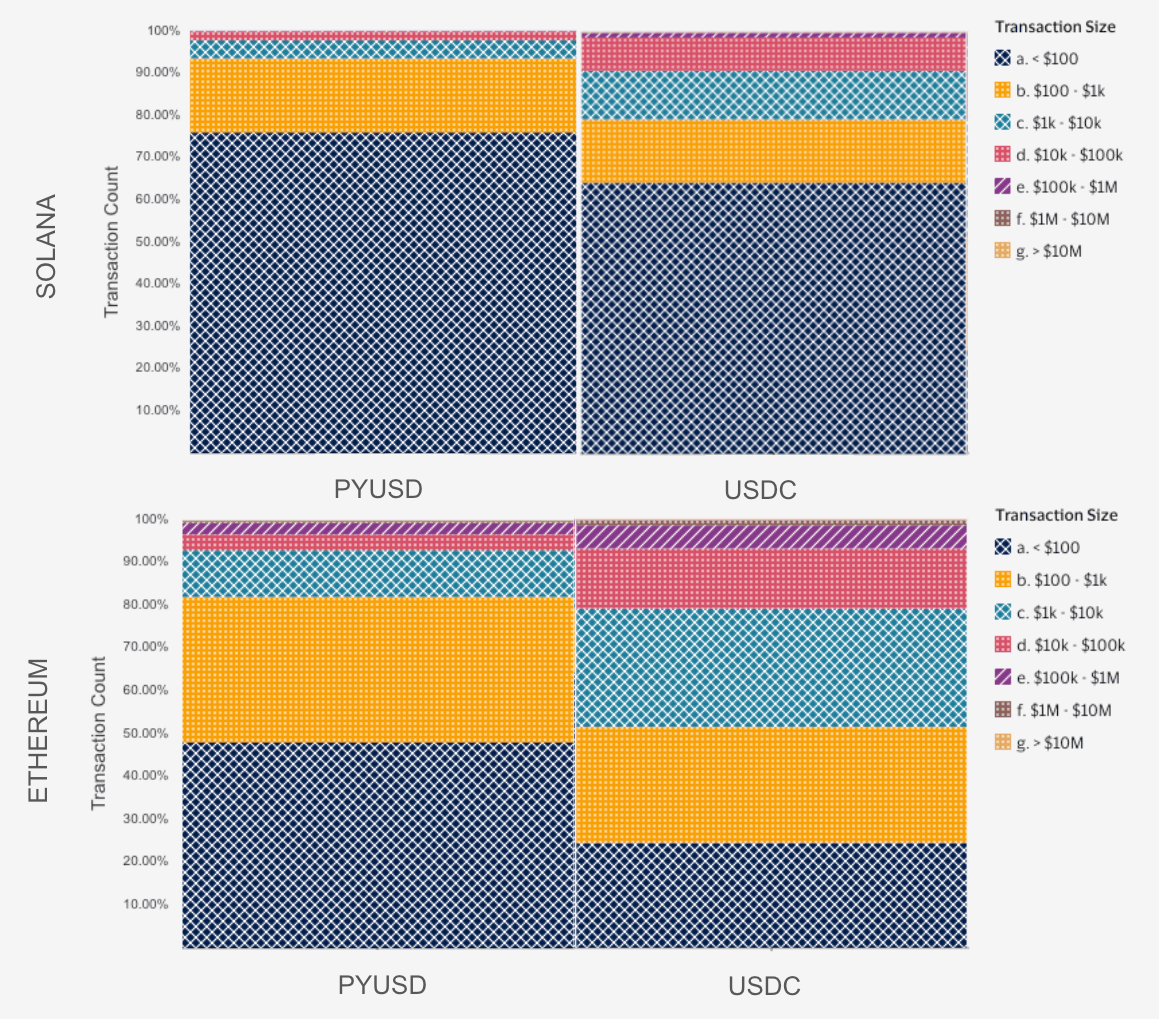

Also in line with PayPal’s stated goals, traction appears to be coming from run-of-the-mill retail transactions. PYUSD’s transaction distribution skews heavily towards smaller sizes with more than 90% and 80% being for less than $1,000 in Solana and Ethereum, respectively.

That long tail of small transactions is what you would expect if people are starting to top-up, tip, or remit with the token rather than settling trades between institutions.

So… Success?

By our scorecard PayPal has ticked roughly half the boxes required to justify launching its own coin:

✅ Multi-year commitment: Dedicated crypto organization, ambitious roadmap

✅ Regulatory stamina: Lobbying for GENIUS, enduring SEC inquiry

⏳ Deep product embed: User wallets live; merchant /enterprise pending

⏳ High-value use cases: B2B pending, Fiserv link is first true B2B ecosystem play

✅ Ecosystem embrace: Third-largest of its cohort (no, USD1 doesn’t count); Solana liquidity strong

PayPal has ticked maybe half the boxes.

Half-empty take: PYUSD user adoption remains “limited” relative to PayPal’s huge customer base (internal usage data remains private — that’s probably all you need to know).

Rewards and fee-free Coinbase ramps may attack the “why bother” hurdle Chriss alluded to, but he himself agrees that won’t be enough, saying that cross-border transfers are the most likely first use case to gain traction.

Today, less than 10% of the company’s revenue stream is truly “PYUSD-ready” (Wallet, Venmo, Xoom), and without B2B cross-border and merchant-side economics (sub-1% fees, instant FX), the flywheel for real payments volume is missing a tooth or two.

PYUSD must not remain peripheral to PayPal’s core profitability or risks plateauing as a crypto-savvy savings dollar.

Half-full take: PYUSD is the most successful enterprise stablecoin and the best is yet to come. With the work done on the consumer side, and regulatory tailwinds, PayPal can now fully commit to higher-value use cases on the business end. PayPal processes over a trillion and controls corridors that move billions routing them through PYUSD is the logical step forward.

PayPal has built for itself an impressive defensive moat as Visa and Mastercard rush to turn stablecoins into a commodity settlement layer. Owning the token lets PayPal keep a margin others will be forced to surrender.

Other Stories Worth Your Time

Real-World Asset boom — On-chain RWAs now top $24B, up 380% since 2022, and nearly $14B (60%) sits in tokenized private-credit pools, according to RedStone’s 2025 report. Big TradFi names like BlackRock and JP Morgan are the main drivers, signalling the asset class has moved past pilot mode.

Codex mainnet goes live with native USDC — Fresh off a $16M raise from Dragonfly, Coinbase & Circle Ventures, Codex has launched a purpose-built chain that lets stablecoins travel bridge-free. Day-one perks include instant swaps and “atomic off-ramps”; support for USDT & EURC is next.

Circle’s equity flips its own stablecoin — Shares of newly-public CRCL jumped 13 % to value Circle at $66 B, overtaking USDC’s $60 B float. Traders are front-running a U.S. stablecoin bill and Circle’s broader tokenization/payments stack.

Kraken unveils Krak — a Cash App-killer powered by stablecoins — The exchange’s new peer-to-peer app lets users move 300+ crypto & fiat assets across 100+ countries, no bank details or wallet addresses required. Upcoming perks: virtual cards and yield on idle USDG.

Dinari clinches first U.S. broker-dealer licence for tokenized stocks — FINRA’s green light lets the startup list “dShares,” blockchain representations of U.S. equities and ETFs, paving the way for 24/7 trading and near-instant settlement—if liquidity follows.

Crypto Custodian Anchorage Phasing Out USDC Use — The firm rated USDC and AUSD poorly for regulatory oversight and reserve management, and said it will start phasing out and direct institutional clients to convert USDC and other stablecoins into Paxos’ Global Dollar (USDG)

That wraps the second issue of Real World. If you found this helpful, forward it to someone who still believes there’s no use case for crypto.

Tips, corrections, rants? Let me know (@storaker), or contact the editors at [email protected].

See you next week and keep it real.