- Real World

- Posts

- USDKG: A stablecoin to break the global economic order?

USDKG: A stablecoin to break the global economic order?

Kyrgyzstan just launched a gold-backed dollar. The U.S. should pay attention

Hello Real World!

I’m Chris (@storaker), and this is Real World—The Defiant’s weekly update on stablecoins, tokenization, and RWAs.

In this week’s issue we dive into how Kyrgyzstan has quietly become Central Asia’s newest crypto laboratory. In the shadow of the Kremlin and with the blessing of Binance’s founder, the country is minting gold-backed stablecoins, launching a CBDC, and building a new kind of dollar payments system — one that doesn’t need Washington’s permission.

Let’s get real,

Chris

UN-Limited Limit Orders

Why pay gas for limit orders that never execute? With CoW Swap, you can set an unlimited number of limit orders – more than your wallet balance – then cancel them all at no cost to you. Try Limit Orders.

USDKG: A stablecoin to break the global economic order?

Kyrgyzstan, a small Central Asian nation with a newly-found wealth, may become the latest battleground in global geopolitics, and stablecoins are the weapon of choice.

Pacing the marbled halls of Bishkek these days you may find the pardoned Changpeng “CZ” Zhao, the billionaire founder of Binance, advising top government officials in the Crypto Council. CZ days ago said he wanted “to help America become the capital of crypto”, but scratch that; Kyrgyzstan is where it’s at.

In recent weeks, the 7-million people nation launched a som-denominated stablecoin, KGST on BNB Chain and is working on a CBDC pilot. It also established Bereket Bank, its first private bank dedicated to digital assets — controversially co-founded by the President’s son, and CZ first denying and then deleting his denial of involvement).

In parallel, Kyrgyzstan’s Ministry of Finance announced the launch of USDKG, a U.S. dollar-pegged stablecoin backed by gold reserves held in custody of the State Development Bank to facilite international trade.

So, what’s going on here? In one word, Russia.

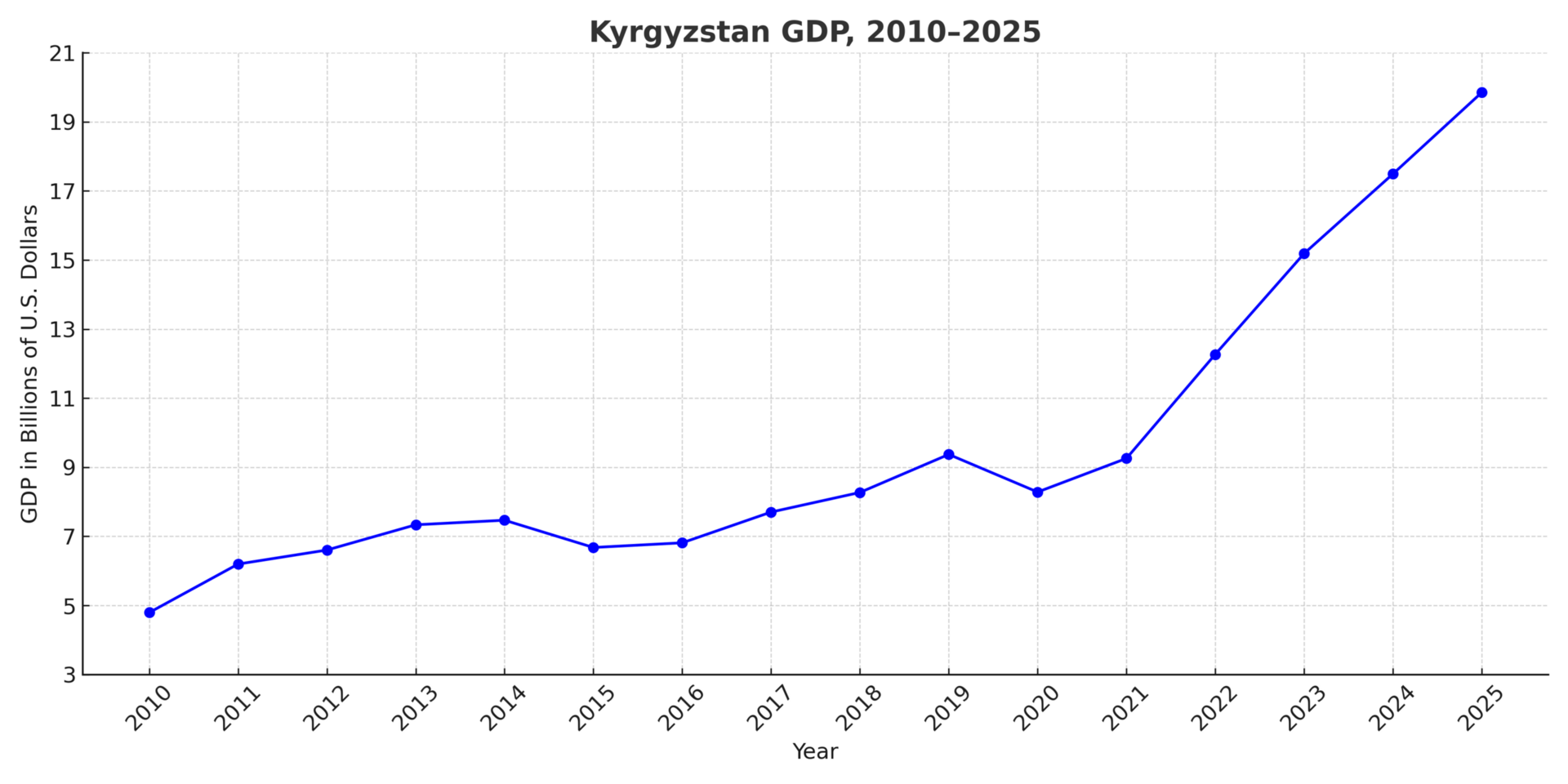

Remittances from Russia have traditionally been a crucial lifeline for the post-Soviet country (as much as ~30% of GDP in 2021). But since Russia invaded Ukraine, the Kyrgyzstan’s economic output has more than doubled.

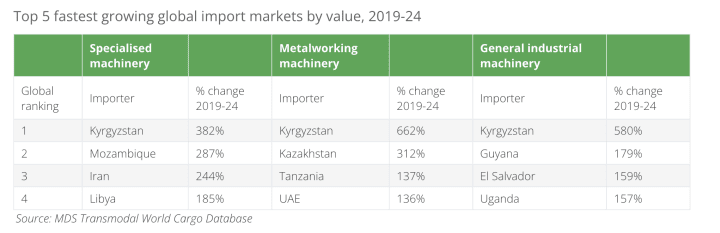

The war’s uncertainty and geopolitic turmoil, have driven a meteoric rise in price the price of gold, boosting Kyrgyzstan’s largest traditional export. Meanwhile, because Kyrgyzstan and Russia share customs-free zone under the EAEU, the country has become a hub for re-exports and trade arbitrage — funneling goods (some under sanctions) into Russia.

So, if you’re Kyrgyzstan and the gold, and Russian remittances and re-export money are all flooding in, the last thing you want is a payments bottleneck slowing you down.

Getting rich on Russian money isn’t easy.

Multiple Russian entities are under sanctions, SWIFT has suspended major Russian banks, and Visa and Mastercard have exited the market entirely.

So, what are your options? You can connect to Russia’s SPFS, Russia’s domestic network with gateways to about 100 foreign institutions. You can set up old-style correspondent accounts. But that’s clunky, slow, and politically risky.

Enter stablecoins. USDT and other stablecoins are widely used, but (a) issuers face mounting regulatory scrutiny and blacklist wallets with no recourse (as Tether has with sanctioned Russian exchanges), and (b) Kyrgyz authorities want tighter integration with their financial system, as in stated-endorsed.

Introducing USDKG

Kyrgyzstan is working hard to make USDKG appear robust and legitimate: a mandatory polished white-paper, Consensys auditing the smart contracts, promises of transparent attestations, and a parade of Windsor-knot-wearing Western advisors, etc. It’s a far cry from previous state-backed crypto disasters (looking at you, Venezuelan’s Petro). It checks the right boxes, while also while appealing to a crypto crowd nostalgic for the gold standard.

USD-stablecoin issuers like Tether and Circle make billions from holding treasuries, but that also makes then vulnerable to Washington’s reach. Kyrgyzstan looked around and saw gold (which it literally digs from the ground). You don’t earn yield, but if gold always keeps rising, defending the peg should be easy work (right?).

So, USDKG makes everyone happy:

Kyrgyzstan gets next-gen payments rails for trade.

Re-exporters can keep invoices in dollars.

Migrant workers can send remittances from Russia cheaper and faster.

The president’s son gets hands-on experience intermediating fiat-to-stablecoin flow at his crypto bank.

Putin gets a small scale proof-of-concept for his long-dreamed BRICS gold-backed currency

The U.S. might not be thrilled

It’s easy to dismiss USDKG simply as sanctions-evasion scheme. TradFi voices will say, “See? I told you crypto’s for criminals.” But let’s add nuance: 99.5% of crypto activity is legitimate. Yes, sanctions evasion accounts for about 39% of illicit crypto use, and 60% of that now occurs in stablecoins. Still, there’s nothing illicit about a Kyrgyz migrant using a stablecoin to send money home.

Source: Bitwise

Beyond sanctions

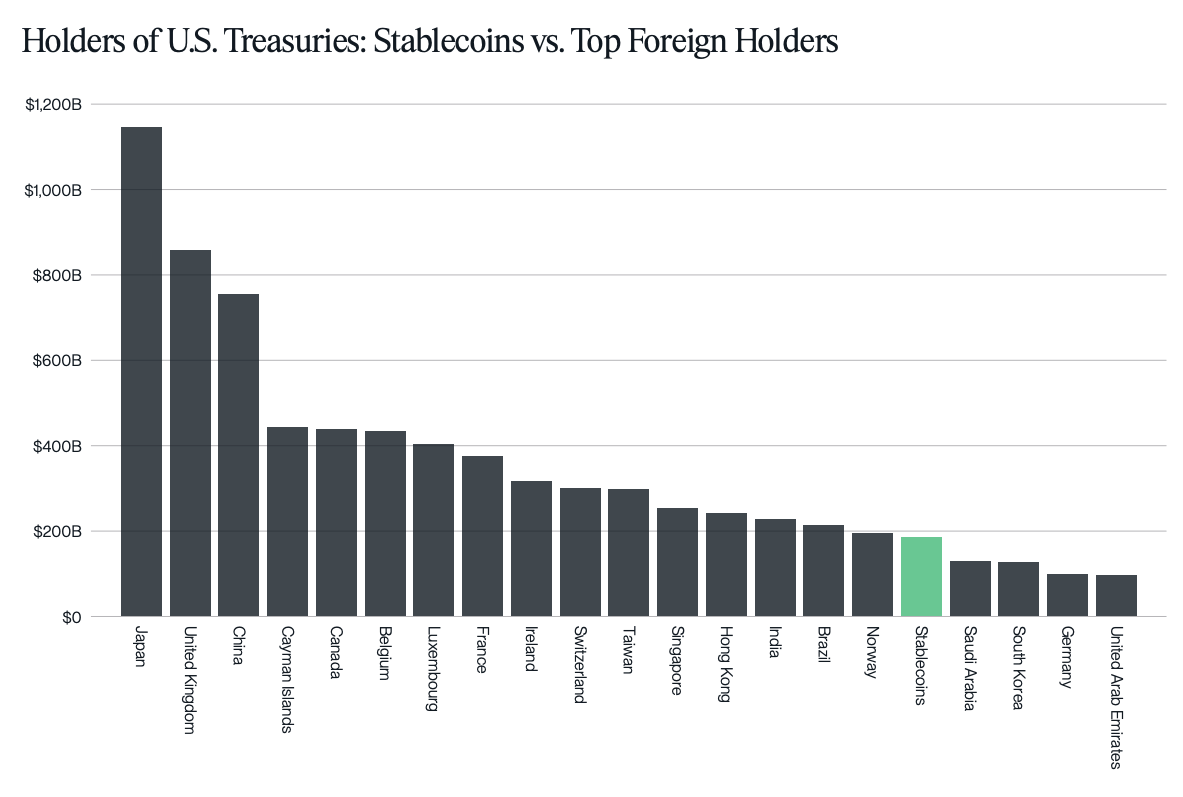

USDKG is a fascinating experiment: both leveraging and challenging U.S. dollar dominance. USD-stablecoin issuers are now among the largest buyers of U.S. debt; Kyrgyzstan’s dollar-denominated stablecoin will hold none.

USDKG will not displace USDC or USDT, but you can be sure Moscow and Beijing are watching closely.

Other Stories Worth Your Time

Payments

Rain joins Western Union’s Digital Asset Network — Rain will participate in Western Union’s network to support digital-asset/ stablecoin settlement for certain use cases.

Citi & Coinbase to enhance corporate digital-asset payments — Citi’s press release announces a partnership to expand digital-asset payment capabilities for Treasury and Trade Solutions clients via Coinbase infrastructure.

Visa discloses $140B cumulative crypto card volume since 2020 — Visa has operated 130+ crypto card programs across 40+ countries, processing more than $140B in combined crypto and stablecoin payment volume since 2020. It also says Visa is adding support to more stablecoins and blockchains, convertible to 25+ fiat currencies.

Solana, Fireblocks, Monad, Stellar and TON join forces on institutional payments framework — consortium to build technical and compliance standards for blockchain-based payments. The group aims to address fragmentation across stablecoin networks and improve interoperability for financial institutions.

Tokenization

Custody banks build tokenization services — Global custodians (e.g., BNY Mellon, State Street, Northern Trust) are developing tokenization, settlement, and servicing capabilities in response to client demand.

JPMorgan’s Kinexys supports tokenized PE fund flows — Kinexys Fund Flow enables on-chain workflows for private-equity fund operations, including capital calls and redemptions, providing shared visibility for participants.

Tether, KraneShares, Bitfinex Securities form tokenization alliance — Hadron (associated with Tether) and Bitfinex Securities will work with ETF issuer KraneShares to develop tokenized versions of traditional securities.

Mantle, Bybit, Backed announce tokenized U.S. stocks — tokens referencing U.S. equities (e.g., NVDAx, AAPLx, MSTRx) will trade on Mantle’s network with 24/7 access, and are described as backed 1:1 by underlying securities.

Securitize to go public via $1.25B SPAC — press release says Securitize agreed to combine with Cantor Equity Partners II at a $1.25B valuation.

Ripple raises $500M at a $40B valuation — Ripple closed a $500M round led by Fortress and investors including affiliates of Citadel Securities. Proceeds to fund expanding payments, custody, and institutional products

Stablecoins

Ripio unveils ARS-pegged stablecoin “wARS” — Argentine exchange launched a peso-denominated token on multiple chains to enable on-chain ARS transfers. The article emphasizes availability and intent (payments/hedging) rather than publishing a reserve breakdown.

Stables Labs USDX depegs amid liquidity-drain allegations — AMBCrypto reports Stables Labs USDX fell sharply to around $0.37 after on-chain movements raised concerns about collateral outflows tied to the founder.

Kyrgyzstan announces gold-backed stablecoin (USDKG) — the Ministry of Finance introduced a gold-backed token pegged to USD, describing redemption options and planned scale.

Chainlink & Apex pilot compliance with BMA — CoinDesk reports Chainlink and Apex Group conducted a pilot with the Bermuda Monetary Authority focused on real-time reserve and compliance visibility for stablecoin issuers.

U.S. Bank explores stablecoin uses in trade finance — U.S. Bank is evaluating stablecoins for trade-finance workflows and has previously worked with Anchorage Digital on digital-asset services.

Brazil pauses BREX CBDC pilot; shifts to asset-collateralization work — The Brazil’s central bank has halted its retail CBDC pilot to focus on building a collateralization platform for digital assets.

Regulation & Policy

Fed Governor flags multi-trillion stablecoin impact on policy — Fed Governor Stephen Miran said staff scenarios show stablecoin usage could reach $1T–$3T by the end of the decade. He argued monetary policy needs to account for effects on Treasury demand and liquidity as tokenized dollars scale.

BoE to move on a similar timetable as the U.S. — the Bank of England said UK stablecoin rules will be in place “as quickly as the U.S.” The article frames timing and coordination; it doesn’t set quantitative caps or final parameters.

Bank of England Opens Consultation on GBP Stablecoin Rules —consultation setting out how it will regulate systemic pound-denominated stablecoins. The proposal includes potential temporary limits on holdings, detailed redemption obligations, and coordination with the FCA for smaller issuers.

Canada Begins Work on Stablecoin Regulation — Canada’s Department of Finance announced that it is moving forward with a national framework to regulate stablecoins, focusing on fiat-backed digital assets that function as payment instruments.

Japan’s FSA supports megabank stablecoin work — the Financial Services Agency will support MUFG, SMBC, and Mizuho as they explore a joint stablecoin initiative under Japan’s legal framework for electronic payment instruments. It highlights supervisory support rather than specific launch dates.

Circle submits GENIUS Act implementation comments — Circle’s blog post details recommendations for U.S. stablecoin rules, including high-quality liquid asset backing, monthly reporting, and consistent standards for bank and non-bank issuers.

Tips, corrections, rants? Let me know (@storaker), or contact the editors at [email protected].

See you next week and keep it real.